eRVD Bill

Q1. What type of demand notes will be covered by the eRVD Bill service of the Rating and Valuation Department?

The eRVD Bill service of our department covers : (i) the quarterly Demand for Rates and/or Government Rent issued around early January, April, July and October every year; and (ii) the Demand for Rates and/or Government Rent (inclusive of surcharges) issued around middle of February, May, August and November every year to eRVD Bill service subscribers with outstanding payments.

Other demand notes, such as acknowledgement demand issued after change of payer's particulars, replacement demands, etc., will still be issued in paper form.

Back to Top

Other demand notes, such as acknowledgement demand issued after change of payer's particulars, replacement demands, etc., will still be issued in paper form.

Back to Top

Q2. Who can apply for the eRVD Bill service of the Rating and Valuation Department?

Q3. How can I apply for the eRVD Bill service?

You must apply for an account at MyGovHK portal first. For registration, please click www.gov.hk. After registration, you can select RVD's eRVD Bill service and add the rates and/or Government rent account to your eRVD Bill profile online.

Back to Top

Back to Top

Q4. Is it necessary for the username of MyGovHK account to be the same as the registered payer's name of the rates and/or Government rent account? What information do I need to provide if I want to register for the eRVD Bill service?

The registered payer's name can be different from the user name of the MyGovHK account. To add a rates and/or Government rent account to your eRVD Bill profile, you must input the correct 15-digit Account No. and the payer's name as shown on your Demand for Rates and/or Government Rent.

Back to Top

Back to Top

Q5. When will I receive the first electronic demand after I have added my rates and/or Government rent account to my eRVD Bill profile?

When the account is successfully added to a eRVD Bill profile, a letter will be sent to the registered payer's correspondence address informing the payer of the quarter from which the issue of electronic demand will be effective.

Back to Top

Back to Top

Q6. Can I add more than one rates and/or Government rent account to my eRVD Bill profile for receiving electronic demands?

Yes. You can add more than one rates and/or Government rent accounts to your eRVD Bill profile.

Back to Top

Back to Top

Q7. I am receiving the quarterly demand in both electronic and paper form in each quarter. I do not want to receive paper demand any more. What can I do?

You can log on RVD's eRVD Bill system and opt to "Suppress paper demand" or "Suppress paper demand schedule" (for consolidated account only). The instruction will take effect from the next quarter.

Back to Top

Back to Top

Q8. I have opted to receive electronic demands only. Why do I still receive Demand for Rates and/or Government Rent (inclusive of surcharges) in paper form?

The paper surcharge demand is to ensure that you are aware of the late payment so that early settlement of the outstanding sum can be made.

Back to Top

Back to Top

Q9. How long will the electronic demands be kept in the system for retrieval?

Electronic demands will be kept in the system for the past 12 quarters, starting from the effective quarter after the successful registration of eRVD Bill service.

Back to Top

Back to Top

Q10. Can a rates and/or Government rent account be added to more than one eRVD Bill profile for receiving electronic demands?

Q11. I am receiving electronic demand only, but I want to receive paper demand note in addition to the electronic demand now. What can I do?

You can log on RVD's eRVD Bill system and opt to "Resume paper demand". The instruction will take effect from the next quarter. Paper demand note will be sent by post to the registered payer at his/her registered correspondence address.

Back to Top

Back to Top

Q12. I have received a letter from RVD informing me that the rates and Government rent account of my property has joined eRVD Bill service, but I have not applied for it. What should I do?

Someone has opted to receive electronic demand for your property. To terminate the eRVD Bill service and prevent other people from applying for the service on your behalf, please send a written request to the Rating and Valuation Department, together with supporting documents proving your property ownership, such as Land Registry's record.

Back to Top

Back to Top

Q13. How can I know when an electronic demand has been sent to me?

A notification message will be sent to your MyGovHK account when an electronic demand is available.

Back to Top

Back to Top

Q14. If I want to cease receiving electronic demands for my rates and/or Government rent account, what should I do?

You can log on your MyGovHK account and remove the rates and/or Government rent account from your eRVD Bill profile.

Back to Top

Back to Top

Q15. I have purchased a property but the previous owner is still receiving electronic demand notes of the property. Can I stop him from receiving the electronic demand of my property?

You can notify the Rating and Valuation Department in writing of the change of payer. After updating the payer's particulars, the rates and/or Government rent account will automatically be removed from the relevant eRVD Bill profile. The ex-owner will not receive any electronic demand from the subsequent quarter onwards.

Back to Top

Back to Top

Q16. I am the new property owner. I have received the demand note of my property with the payer's name as "業主/住戶 The Owner/Occupier". Can I join the eRVD Bill service?

Since the payer's name is not clear, please update the payer's particulars first and join eRVD Bill service after the payer's record is updated. To change payer's particulars, please visit : www.rvd.gov.hk for details.

Back to Top

Back to Top

Q17. I am not using eRVD Bill service and I have not received the paper demand note for this quarter. Can I request a copy of the original demand?

This department does not keep duplicate hardcopy of the demand. In your case, you may submit an online form through the website of this Department to obtain replacement demand (if there is amount payable) by mail or telephone 2152 2152 (24-hour Automated Telephone Enquiry Service) to obtain replacement demand by mail or by fax.

Alternatively, if you wish to settle to the payment of rates and/or Government rent without the need of obtaining replacement demand, you can enquire the account balance by using "Account Enquiries" service or calling 2152 2152. For instant payment, you may obtain the payment QR code from the "Account Enquiries" service by using mobile devices and present it for making payment at any post office, 7-Eleven, Circle K or VanGo in Hong Kong.

Back to Top

Alternatively, if you wish to settle to the payment of rates and/or Government rent without the need of obtaining replacement demand, you can enquire the account balance by using "Account Enquiries" service or calling 2152 2152. For instant payment, you may obtain the payment QR code from the "Account Enquiries" service by using mobile devices and present it for making payment at any post office, 7-Eleven, Circle K or VanGo in Hong Kong.

Back to Top

Q18. I am a consolidated account holder. Can I join eRVD Bill service?

You can use the eRVD Bill service to receive the consolidated quarterly demand note and the demand schedule via the Internet. You need to first apply for a MyGovHK account. Then you can select RVD's eRVD Bill service and add the consolidated account to your eRVD Bill profile. You will receive a letter with an activation code for activating the eRVD Bill service of your consolidated account. After the successful activation of the service, you will be able to retrieve and download the electronic copies of the consolidated demand and the demand schedule each quarter.

Back to Top

Back to Top

Q19. I am a consolidated account holder and have subscribed for eRVD Bill service. Can I add or remove an individual tenement account online?

Yes. To update your consolidated account, you can log on RVD’s eRVD Bill system to add or remove individual tenement account(s) to or from your consolidated account. A notification will be sent to your MyGovHK account to inform you of the update result. A letter will also be sent to the correspondence address of the consolidated account for successful update.

Back to Top

Back to Top

Q20. I am a consolidated account holder and have joined eRVD Bill service. Before I join the eRVD Bill service, I have set up autopay instruction in most of my tenement accounts. Why my consolidated account cannot be settled by autopay?

It is because some tenement accounts do not have autopay arrangement. As a result, all autopay instruction of other tenement accounts have been cancelled upon setting up of the consolidated account.

If you want to use autopay to settle your consolidated account in the future, you have to approach your bank to set up the instruction again using the consolidated Account No..

Back to Top

If you want to use autopay to settle your consolidated account in the future, you have to approach your bank to set up the instruction again using the consolidated Account No..

Back to Top

Q21. How can I enquire about the billing information on the electronic demand, such as amount payable, due date, payment information, etc?

You may enquire the billing information through our eRVD Bill service or call our 24-hour customer service hotline at 2152 0111.

Back to Top

Back to Top

Q22. Can I create a consolidated account under eRVD Bill service?

You can apply for creation of a consolidated account online if you have at least 10 tenement accounts. A notification will be sent to your MyGovHK account to inform you of the application result. A letter will also be sent to the correspondence address of the consolidated account for successful application.

Back to Top

Back to Top

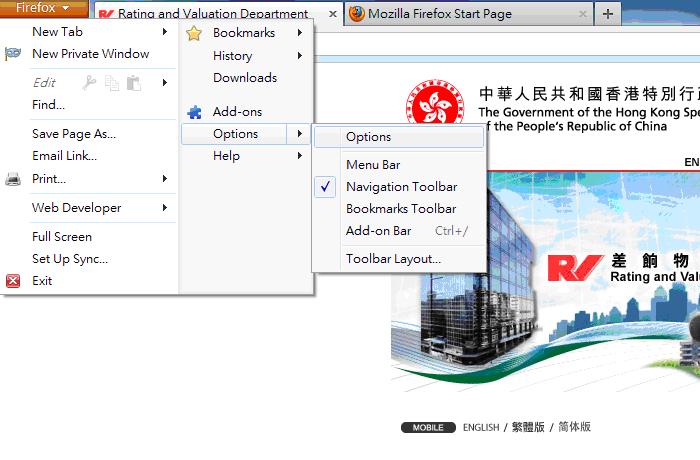

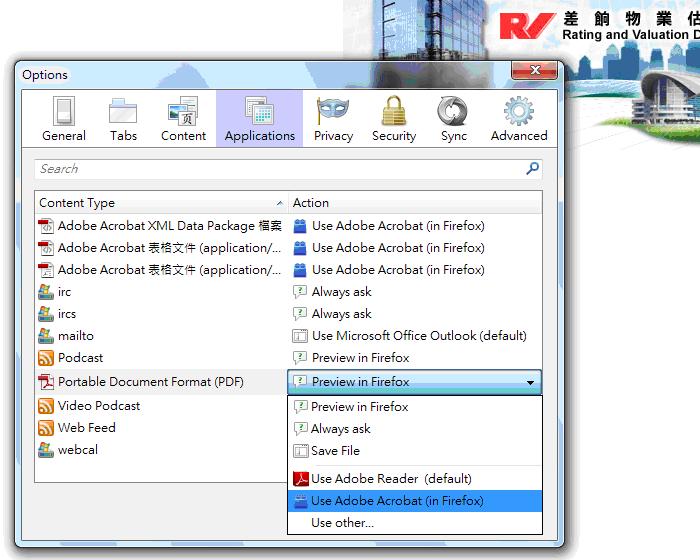

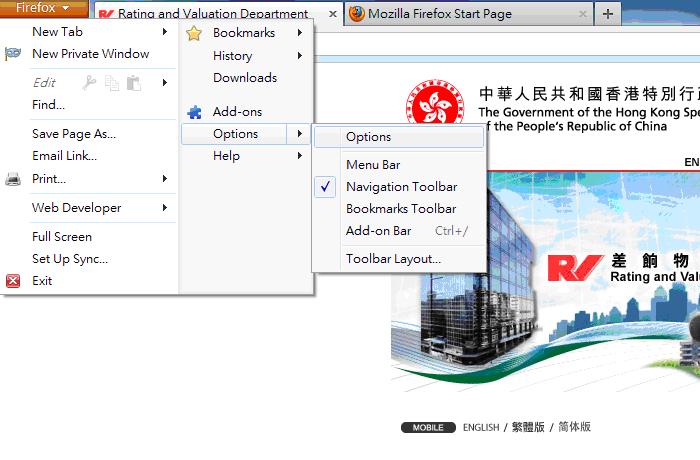

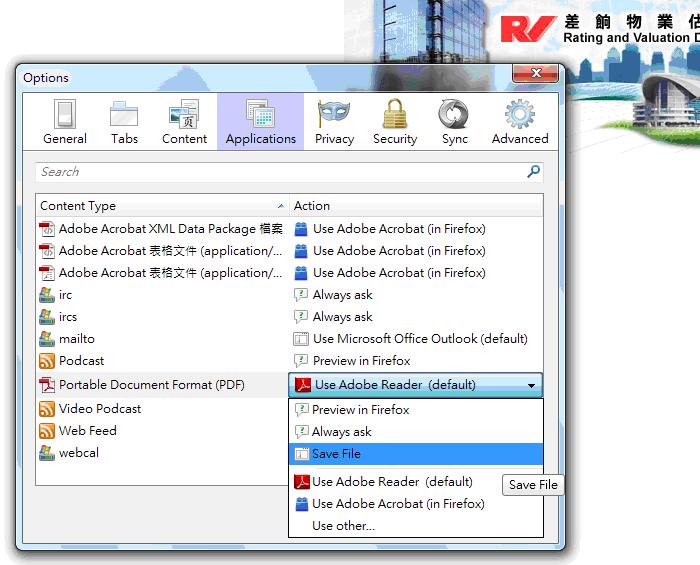

Q23. When I try to view my eBill in Firefox browser, why the Chinese characters cannot be displayed properly?

We understand that the new version of Firefox web browser has introduced a new built-in PDF viewer by default. Chinese characters may not be properly displayed if the PDF document is viewed by this browser built-in PDF viewer. Please try the following options to resolve the issue.

Back to Top

-

Option 1: Use Adobe Acrobat Reader to view the PDF document in Firefox web browser

-

Open Firefox and select "Options".

-

Select "Applications". Find "Adobe Acrobat Document (PDF)" and change the action to "Use Adobe Acrobat (in Firefox)".

- Close Firefox and start Firefox again.

-

Option 2: Save the PDF document in Firefox

-

Open Firefox and select "Options".

-

Select "Applications". Find "Adobe Acrobat Document (PDF)" and change the action to "Save File".

- Close Firefox and start Firefox again.

Back to Top

Q24. How can I know an application is successfully submitted to RVD?

An on-line acknowledgement message will appear after successful submission of an application. The message will show the date and time of submission, a transaction reference number together with some important notes about the application. You may print or save the message for future reference if necessary.

Back to Top

Back to Top

Online Payment

Q1. What are the advantages of making online payment through the eRVD Bill System?

Through the eRVD Bill System, payers can make use of the PPS Shop & Buy payment service provided by EPS Company (HK) Ltd. With the PPS Shop & Buy, you can settle payment with PPS at the eRVD Bill System directly. Just simply select PPS for payment at the eRVD Bill System, the transaction details will be sent to the PPS System. This can greatly facilitate your online payment transactions. Payers who have to settle multiple eBills can pay his demands in one single transaction through the eRVD Bill System.

Back to Top

Back to Top

Q2. How do I pay the rates and Government rent under the eRVD Bill System?

You can make immediate online payment under the eRVD Bill System by PPS. However, if you want to pay by other means, such as by credit card, you may make use of the hyperlink as provided in the Treasury’s webpage to make payment via Internet banking or PPS.

Back to Top

Back to Top

Q3. Can I settle more than one Demand for rates and/or Government rent in one single PPS payment transaction?

Q4. Can I settle the demand which has not been opted for eBill by using Online Payment under the eRVD Bill System?

No. At present, only the eRVD Bill service subscriber can use online payment under the eRVD Bill System to settle the eBill(s) under his/her eRVD Bill account profile.

Back to Top

Back to Top

Q5. How can I check if RVD has received the payment?

After completing an online transaction, you should print and retain the acknowledgement page, which contains key information about the transaction including the 16-digit transaction reference number that would allow you to check the transaction status with RVD. Besides, the payment history of your rates and/or Government rent account will also be updated to the eRVD Bill System on the next working day. Payment history of up to the past 8 quarters of your account will be kept in the eRVD Bill System.

Back to Top

Back to Top

Q6. I used to pay the rates and/or Government rent via PPS by Internet. I can check my payment record in my PPS account by Internet. If I settle my eBill by using the online payment under the eRVD Bill System, can I still check such payment record in my PPS account?

Yes. You can check the payment record in your PPS account by Internet. After logging on your PPS account by Internet, you can click on the “Payment History” folder, then click “View payment history of PPS Shop & Buy Service” button. The payment transaction details including Payment Reference No., Merchant Name, Amount (HK$) and Payment Date and Time will be displayed. You can save or print such records for reference.

Back to Top

Back to Top

Q7. Can I preset forward bill payment instructions by making use of RVD's online payment service?

No. RVD is using the PPS Shop & Buy payment service provided by EPS Company (HK) Ltd. There is no such facility under the PPS Shop & Buy payment service.

However, payers can make use of the hyperlink as provided in the Treasury’s webpage to make payment via Internet banking or PPS which allows presetting forward bill payment instructions.

Back to Top

However, payers can make use of the hyperlink as provided in the Treasury’s webpage to make payment via Internet banking or PPS which allows presetting forward bill payment instructions.

Back to Top

Q8. I have a PPS account. Do I need to register my Demand for Rates and/or Government Rent in my PPS account before I can use the online payment under the eRVD Bill System for making payment?

No. You don’t have to register your demand note in your PPS account. After viewing your quarterly demand under the eRVD Bill System, you can press the “Pay by PPS” button. The system will direct you to the PPS website and forward the necessary transaction details to make the online payment. You only need to enter your 8-digit PPS Account No. or PPS Account Name, PPS Internet Password for processing the payment.

Please visit the PPS website (www.ppshk.com) to find out how to register for a PPS Internet password and details on browser compatibility and other technical information.

Back to Top

Please visit the PPS website (www.ppshk.com) to find out how to register for a PPS Internet password and details on browser compatibility and other technical information.

Back to Top

Q9. Who will receive my PPS account information when I enter it for online payment under eRVD Bill System?

Your PPS account information is captured by the payment service provider – EPS Company (HK) Ltd. GovHK and the Rating & Valuation Department cannot access such information.

Back to Top

Back to Top

Q10. Why does RVD's e-payment service through eRVD Bill System only allow payment by PPS but not credit card?

It is not considered cost-effective for the Government to accept credit card payment under the eRVD Bill system. However, payers can make use of the hyperlink as provided in the Treasury’s webpage to make payment via the Internet. A number of banks also offer to their customers the Internet "Bank Bill Payment" service which allows the payment of government bills and other specified bills by credit card. In such cases, payers are required by their banks to observe the terms and conditions of the "Bank Bill Payment" service which may vary from bank to bank, particularly regarding the cut-off time and service charges, if any, set by each bank. (For details, please refer to the Treasury’s webpage on Payment of Government Bills under the Collections and Payments column.)

Back to Top

Back to Top

Q11. I have received my eBill for this quarter and after that I have deleted the account from my eRVD Bill profile. I cannot make the online payment under the eRVD Bill System for that account now. Why?

The online payment under the eRVD Bill System is only available for eRVD Bill service subscriber who has received the eBill for the latest quarter and the account has to be included in the eRVD Bill profile at the time of payment. If you have deleted the account from your profile, you cannot use the online payment means. Nevertheless, you can make use of the hyperlink as provided in the Treasury’s webpage to make payment via the Internet or other payment means as shown at the back of the demand notes, including paying in person at post office or by post, payment via ATM machines, etc.

Back to Top

Back to Top